|

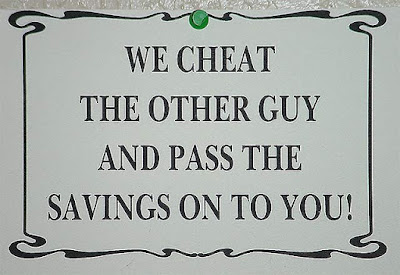

| Bruce Fingerhood "Save" Sign in antique store, Oakland Oregon. |

The sign above is a humorous example of an underlying truth about banking. The bank uses your money in order to lend it to other people. The bank charges them more than they are paying you (that's their profit), but they are paying you. So the bank is charging the other guy (or girl) enough intrest to pay themselves and you too.

In other words:

Sign: We cheat the other guy and pass the savings on to you!

In addition to checking accounts the banks offer savings accounts.

This is where you keep money that you may need within 6 months or less, but probably won’t need within 30 days.

There are two primary purposes to having a savings.

1. To keep money out of your checking so that you are less likely to spend it.

2. To have a place to add to your savings (set aside money) and build it up. Investment advisers say you should have 6-9 months’ income in your savings at any one time.

Generally speaking a savings account with no restrictions will pay less interest. Some savings accounts pay a higher rate of return in exchange for time commitment. These savings accounts are known as “CD’s (certificates of deposit)” or “Time accounts”.

As an example:

A normal savings may be paying 0.15% for $5,000 while a CD may pay 5% for the same $5000 for committing to leave it in for 6 to 12 months. (of course that's when the economy is doing well, it could be closer to 1% or less too).

You may ask:

“I don’t want to lock away my money… what if an emergency comes up?”

That is a great question. I have a question for you first.

“What if you have no emergency how much money will you lose after three years of waiting for an emergency?”

Any funds you don’t plan on needing for 6 months or more should (generally) be placed in CD’s if the rates are much higher.

Some people use the emergency excuse for not putting money into a CD. For example they’ll say that if an emergency came up like car repairs, or doctors’ bills that they didn’t plan on or expect and they need the money they don’t want to have to pay the interest penalties for taking it out.

Some people use the emergency excuse for not putting money into a CD. For example they’ll say that if an emergency came up like car repairs, or doctors’ bills that they didn’t plan on or expect and they need the money they don’t want to have to pay the interest penalties for taking it out.

This could sound reasonable.

But it’s usually not.

The money is there for emergencies. That’s one of the many reasons to own a savings account is to put money away for a time you may need it or want it.

These are not good reasons, however, to stay out of CD’s unless the emergency you’re referring to is not unexpected.

If you’re actively looking for a house and expect to buy soon, or you have a relative who is sick and likely to need medical expenses paid then maybe you were wise to withhold from a CD.

Possible emergencies that you don’t even know about are not good reasons to avoid putting money into a CD. Leave some out for emergencies and put some in for interest. Leave out 40% and put in 60%.

Think strategically.

These are not good reasons, however, to stay out of CD’s unless the emergency you’re referring to is not unexpected.

If you’re actively looking for a house and expect to buy soon, or you have a relative who is sick and likely to need medical expenses paid then maybe you were wise to withhold from a CD.

Possible emergencies that you don’t even know about are not good reasons to avoid putting money into a CD. Leave some out for emergencies and put some in for interest. Leave out 40% and put in 60%.

Think strategically.

~Thinking Beyond Today~

If you need to take the money out early for some unseen emergency you will typically still earn more on the money long term even after the small penalty they charge to take it early. It’s wise to put it in because if you put it in for a 12 month term but then had to break it out after 8 months and paid a 6 month interest penalty, you still earned two months of good interest and that was probably more than you would have earned in a year in the lower interest in a regular savings account.

If you didn’t end up needing it you were even wiser because now you haven’t lost those other 6 months of interest. You remember our case study Robert?

He only put $2,000 in of his own money and never touched it. Where did the $48,000 come from? Compounding.

He only put $2,000 in of his own money and never touched it. Where did the $48,000 come from? Compounding.

Compounding is one of the most powerful forces in the world of finance.

~Exercise: Math Time~

The money earned in a Savings/CD (or for that matter the interest you pay on a loan) is calculated by most banks using a formula called daily compounding (also known as Simple Interest). This is the formula to compute compounded interest for one month:

Balance * Rate * Days in Statement Cycle / 365 = Monthly Interest

Robert put in $2,000 of his own money.

In order to calculate this we must know how to turn a percentage into a decimal figure. To do this simply take the decimal point and move it two spaces to the left. For example 10 % is the number 10.00. Then move the point to the left two spaces which is now 0.10.

In order to calculate this we must know how to turn a percentage into a decimal figure. To do this simply take the decimal point and move it two spaces to the left. For example 10 % is the number 10.00. Then move the point to the left two spaces which is now 0.10.

As for statement cycles, most statement cycles will vary between 28-36 days. Short months, such as February will be less, and long months that include more weekends and holidays may be longer. However for our purposes we will use an average. The average month is 30 days. There are 365 days in a year.

~Example of Roberts IRA~

($2,000 X 0.10 X 30)÷365 = $16.44 Per Month

Robert only earned $16.44 the first month. If you took this amount times 12 months you get $197.28 for the first Year. If you then take that and multiply it by 18 years you only get $3,551.04. At a linear rate of growth he would have only earned $3,551.04 for 18 years’ worth of investment. So where did the growth come from? How did Robert gain over $48,000? That is where compounding comes in to play. The first month he earned $16.44. The next month his balance was $2016.44. So now you plug the new balance into the same equation and you get $16.57.

($2016.44 X 0.10 X 30)÷365 = $16.57

So the second month he’s already earning more than the first month. As this process rolls on and on over the months and years the amounts will eventually get exponentially larger. The bottom line of compounding is: Your interest earns interest.

This is one way to make your money work for you.

I once read a case study of a man who had saved over $850,000. He would take $45,000 a year to live on and keep the rest in a CD. However he was earning nearly $48,000 a year in interest. This means that after taking out his 45K he was still 3K ahead of the previous balance.

Every year his account would get bigger and his income would stay the same. This became a perpetual flow of income for him. This would only work as long as you had the right rate. As rates rise and fall he would have years where he did not earn more than he took out.

However, he also had years where he earned far more than what he took out. He found the best way to balance the flow was to lock in longer terms when he felt rates were peaking and about to drop again.

It's better for your money to work for you than for you to work for your money. This man had put his money to work and therefore he didn’t have to work for his money.

Also the $45,000 a year went much further because he owned both of his homes and all his cars debt free. The average person spends between one quarter and one third of their income on housing/mortgage/rent costs. If you didn’t have to spend that money monthly you could be freed up to do a great many other things.

~Freedom~

What do you pay in mortgage or rent each month? What would you be able to do if you made the SAME income you do now, but DID NOT have to pay that amount to anything but yourself? Would you live differently? What Ministries could you give to? And that is exactly what your goal should be!!!!

The Insider

The Insider is a BIG fan of Dave Ramsey:

- Go read/listen/watch Dave Ramsey and he'll teach you how to do it right!

- Listen to The Dave Ramsey Show (HERE)

- Or by his most popular book: (HERE) The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

![[ { ENDER'S GAME } ] by Card, Orson Scott (AUTHOR) Oct-31-2006 [ Hardcover ]](https://i.gr-assets.com/images/S/compressed.photo.goodreads.com/books/1697162486l/199597832._SX98_.jpg)

0 comments:

Post a Comment

Be Nice, Be Kind, Be Thoughtful, Be Honest, Be Creative...GO!